CPS 234

CPS 234

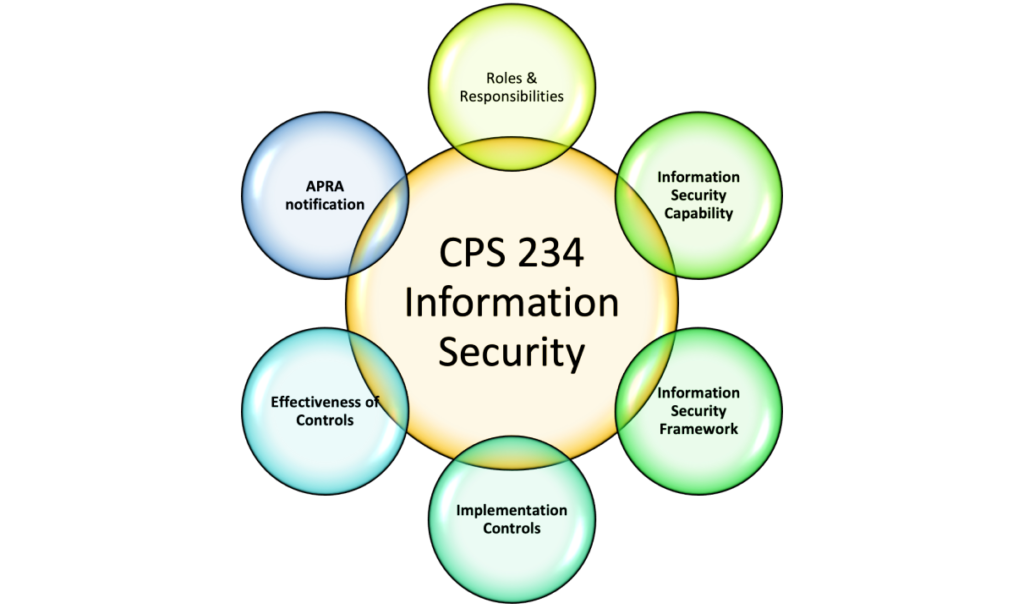

Our CPS 234 Compliance Services are expertly designed to help organizations comply with the Cybersecurity Prudential Standard (CPS) 234 issued by the Australian Prudential Regulation Authority (APRA). CPS 234 focuses on the management of cybersecurity risks within financial institutions and other regulated entities. By aligning your cybersecurity practices with CPS 234, we ensure that your organization effectively manages and mitigates cyber risks, safeguarding critical assets and maintaining regulatory compliance.

Key Features:

- Comprehensive Compliance Assessment:

- Conducts gap analyses, risk assessments, and compliance audits to identify and address vulnerabilities and ensure adherence to CPS 234 standards.

- Cybersecurity Framework Implementation:

- Develops and deploys robust cybersecurity policies and controls, manages documentation, and prepares for incident responses.

- Continuous Monitoring and Improvement:

- Implements real-time monitoring and vulnerability management, tracks performance metrics, and conducts employee training to foster a security-conscious culture.

- Vendor and Third-Party Management:

- Assesses third-party cybersecurity practices and enforces security requirements within vendor contracts to mitigate associated risks.

Benefits:

- Regulatory Compliance: Helps avoid fines and enhances reputation by ensuring adherence to CPS 234.

- Enhanced Cybersecurity Posture: Protects critical assets and enables proactive threat management.

- Operational Efficiency: Streamlines processes and optimizes resource allocation.

- Customer Trust and Competitive Advantage: Builds credibility and differentiates the organization through stringent cybersecurity measures.

- Continuous Improvement: Establishes a framework for ongoing adaptation and enhancement of security practices.

CPS 234 Compliance Services help organizations comply with the Cybersecurity Prudential Standard (CPS) 234 by managing cybersecurity risks effectively. Key features include compliance assessments, policy development, incident response planning, and continuous monitoring. These services enhance cybersecurity posture, ensure regulatory compliance, and build trust with customers, making them essential for financial institutions and other regulated entities.

Use Cases:

- Banks and Financial Institutions:

- Ensure compliance with CPS 234 to protect customer assets, maintain operational integrity, and uphold regulatory standards.

- Insurance Companies:

- Safeguard sensitive policyholder information and financial data against cyber threats, ensuring compliance with CPS 234.

- Investment Firms:

- Protect proprietary trading algorithms, client portfolios, and financial transactions from unauthorized access and breaches.

- Payment Processors and Gateways:

- Ensure the security of payment processing systems to maintain compliance and protect client data.

- Healthcare Organizations:

- Protect patient data and medical records, ensuring compliance with both CPS 234 and healthcare-specific regulations.

- Telecommunications Companies:

- Secure communication networks and customer data, maintaining compliance with CPS 234’s cybersecurity guidelines.